Bitcoin (BTC) and major US Equity Indices like Nasdaq and S&P 500 are reported to be forming a death cross, which indicates that the prices could see further declines. A renowned crypto trader has also predicted that Bitcoin could fall to $65k following a bear wedge breakdown.

The 1.5% drop in the Bitcoin price level has extended its weekly loss to 5.9%, pushing the price down to $82k at press time.

Meanwhile, this headwind appears to transcend the broad crypto market to the US Equity Indices like Nasdaq and S&P 500. According to analysts, assets in these markets look set to be forming a death cross, hinting at a potential bearish extension.

What Happens to Bitcoin and the US Equity Indices?

In a recent update, we discussed the close correlation between Bitcoin and Nasdaq, as they both plunged below crucial resistance levels as Japan’s Yen strengthened along with the rising government bond yields.

According to our market data, a similar correlation exists with S&P 500 as it lost $2 trillion in just three trading sessions – Wednesday to Friday. The Kobeissi Letter also discloses that an additional $120 billion was eroded from the market within a few minutes. Meanwhile, analysts believe that things will get worse in the coming weeks.

Amidst the formation of the death cross, US President Donald Trump is also expected to trigger another bearish catalyst as he discloses plans to impose tariffs on Russian oil. According to reports, the tariff could be as high as 25%, hinting at a possible decline below the $80k support level for Bitcoin. As previously mentioned in our report, a similar move to increase tariffs by 25% on Canadian, Mexican, and Chinese imports saw Bitcoin falling sharply.

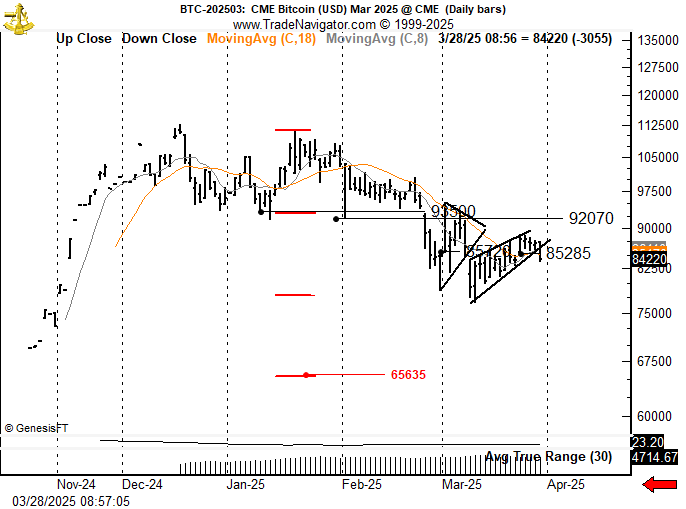

While many analysts are very sceptical about drawing conclusions on a bearish extension, renowned trader Peter Brandt appears confident that Bitcoin could fall to $65,635. According to him, there is a bear wedge breakdown, suggesting this unexpected target.

In an accompanying chart, Brandt highlighted that Bitcoin’s rejection at $92,070 and a subsequent fall below $85,285 confirms this deep fall.

Even so, he urged investors to monitor the charts for another breakdown below $75k to be sure of this estimation.

Don’t shoot the messenger. Just reporting on what the chart says until it says something different. Bear wedge completed with 2X target from the double top at 65,635.

Even though the short-term outlook looks blurry, long-term projections have been made with full confidence, with a partner at Architect Partners Elliot Chun expecting a movement from trading desks to corporate treasuries.

Across all the different strategies and implementations, I anticipate that by 2030, a quarter of the S&P 500 will have BTC somewhere on their balance sheets as a long-term asset.

Echoing a similar position, director of global macro at Fidelity Investments Jurrien Timmer, has disclosed that Bitcoin could outshine gold in a decade. As we discussed earlier, he explained that the asset would have to follow the power law curve or the S-curve trajectory of internet adoption to achieve this milestone.

Buy Bitcoin GuideBitcoin Wallet TutorialCheck 24-hour Bitcoin PriceMore Bitcoin NewsWhat is Bitcoin?