Multiple analysts have predicted that Bitcoin could decline to $60k if it plunges below a crucial support level. Meanwhile, Santiment data suggests that whales are increasingly moving stablecoins to centralized exchanges.

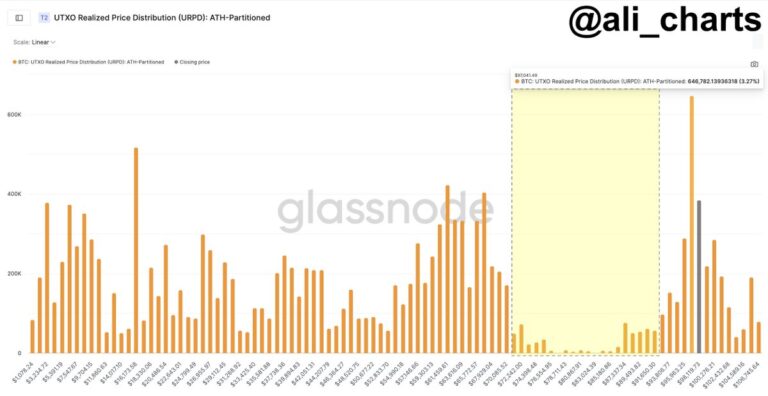

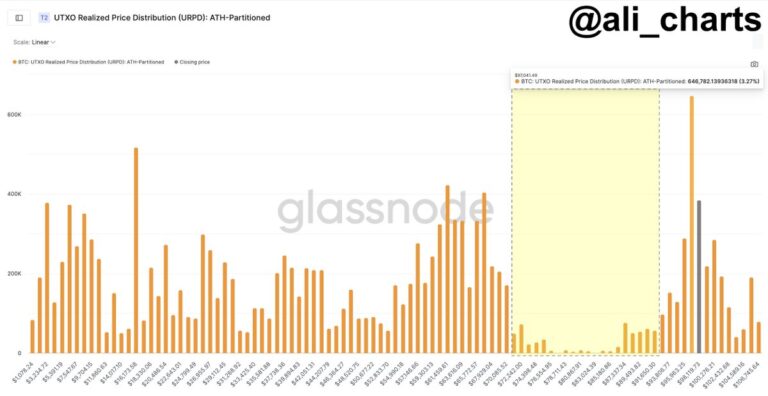

Bitcoin (BTC) has struggled to return to $100k after a massive level of liquidation forced a nosedive from an all-time-high price level of $108k to $91.9k. According to analyst Ali Martinez, the asset currently relies on a crucial support range of $97,041 and $93,806. A fall below this level could send Bitcoin to $70k before the inauguration of Donald Trump.

Supporting this bearish thesis, Martinez highlighted the unexpected surge of Bitcoin exchange reserves. According to him, more than 33k Bitcoin ($3.23 billion) has been transferred to various centralized exchanges, hinting at a possible selling pressure. Meanwhile, profit booking is reported to have contributed to the current position of $95k.

Based on data, investors collectively realized more than $7.17 billion in profits on December 23. Fascinatingly, traders have also reduced their expectation of a near-term rally as the percentage of those holding long positions of the asset on Binance has declined from 66.73% to 53.60%.

Currently, Bitcoin has lost 0.17% of its value on the 24-hour price chart, falling below a crucial support level of $97k, where 1.51 million wallets made a collective purchase of around 1.49 million BTC.

More Bearish Predictions by Analysts

According to Ali Martinez, this bearish trend could be overturned once the asset reclaims its support zone and makes a significant advancement toward $100k. Using the Mayer Multiple, Martinez believes that BTC could rise as high as $168k if it manages to secure and sustain its level above the $100k mark, as we earlier reported.

In agreement with Martinez’s position, crypto analyst Tone Vays has disclosed that BTC could likely decline to $73,000 once it plunges below the $95k mark. According to veteran trader Peter Brandt, the asset could be breaking down from a broadening triangle pattern. Per his thesis, this could drag BTC to the $70k zone.

For Benjamin Cowen, there is a possibility of Bitcoin crashing down to $60k around the inauguration of Trump. Meanwhile, Fundstrat anticipates a run to $250k in 2025.

Joining the discussion, Chartered Market Technician Aksel Kibar hinted that the asset could be declining to the mid $60k. His prediction stems from the analysis of a head-and-shoulders pattern, which usually indicates an uptrend breakdown.

Breakout from the broadening chart pattern that completed on $BTCUSD… the pullback can take place with a possible short-term H&S top. (IF) the right shoulder becomes better defined…Keep this possibility on your watchlist…If the pattern acts as a H&S top, the price target is at 80K. This can be the pullback to the broadening pattern that completed with a breakout above 73.7K.

Amid the backdrop of this bearish trend, Santiment data suggests that whales are increasingly buying the dip. According to the report, a significant amount of stablecoin has been moved to exchanges after post-Christmas.

Being dominated by stablecoin deposits to exchanges…Though it’s not a guarantee that these whales plan to put this dry powder to use right away, consider this a bullish sign as 2024 sees its final days.

Buy Bitcoin GuideBitcoin Wallet TutorialCheck 24-hour Bitcoin PriceMore Bitcoin NewsWhat is Bitcoin?