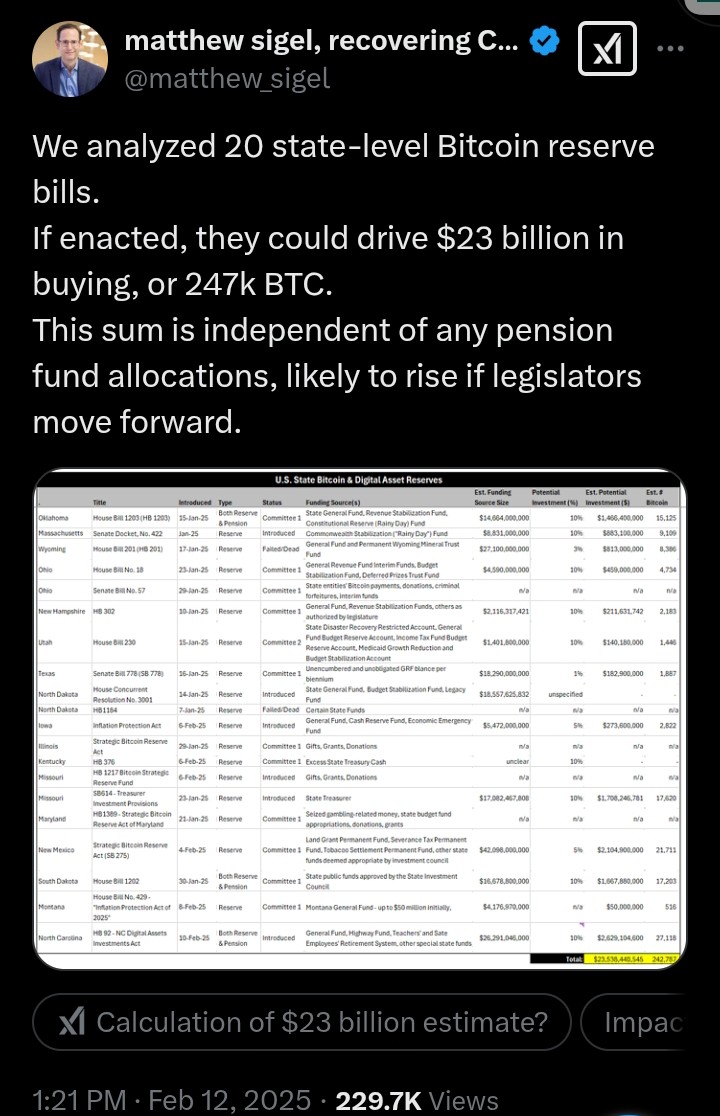

The latest report shared by VanEck’s head of digital assets research highlights the details of the Bitcoin reserve proposals introduced by 20 US states. According to him, the approval of all bills could see at least $23 billion entering the crypto market.

A report posted by the head of digital assets research at VanEck, Matthew Sigel, has disclosed that 20 out of the existing 50 states in the US have submitted bills for strategic Bitcoin (BTC) reserves. According to the report, a successful passage of all bills would drive 247,000 BTC ($23 billion) of funds into the market in a conservative estimate.

The Oklahoma and North Carolina Proposals

Analyzing the attached document, we found that House Bill 1203 (HB1203), submitted by Oklahoma on January 15, 2025, seeks to cover both reserve and pension with the potential investment size fixed at 10%.

According to the report, an estimated investment amount of $14.6 billion could go into this initiative. Meanwhile, the source of funding could be the State General Fund, Revenue Stabilization Fund, and Constitution Reserve Fund.

The most recent bill (HB 92 – NC Digital Assets Investment Act) was submitted by North Carolina on February 10, 2025. According to the report, this will cover both reserve and pension with the funding source expected to be the General Fund, Highway Fund, Teachers and State Employees Retirement System, and special state funds.

Details of the Illinois and Indiana Strategic Reserve

Recently, Rep. John M. Cabello filed a proposal (HB1844) for Illinois to recognize Bitcoin as a financial asset. According to the bill, Bitcoin has inflationary hedge properties with the ability to enhance the fiscal resilience of the state.

The proposal included giving the Illinois State Treasurer the proper authority to hold, secure, and store the asset. Also, residents and government entities were asked to send donations, gifts, and grants in Bitcoin to the Treasurer. In this case, a certificate of acknowledgment was said to be given to those who donate to recognize their contributions.

As summarized in our earlier news story, state Representatives Jake Teshka, Shane Lindauer, and Cory Criswell also filed House Bill 1322 for Indiana. While this bill focused on the recognition of Bitcoin as a state asset, it also proposed an extensive exploration and adoption of the blockchain. Specifically, the potential impact of the blockchain on consumer experience, data security, and government efficiency was proposed to be studied.

The Department of Administration (department) shall issue a request for information for purposes of exploring how the use of blockchain technology could be used by a state agency to (1) achieve greater cost efficiency and cost-effectiveness and (2) improve consumer convenience, experience, data security, and data privacy.

In a recent update, we also discussed the recent plans of Texas Lieutenant Governor Dan Patrick to establish a Bitcoin reserve for the state. According to that report, this initiative was listed as one of the top 40 legislative priorities in 2025.

Amidst the backdrop of this, Bitcoin was trading at $96.8k after surging by 0.82% in the last 24 hours. According to our recent analysis, the Bitcoin price could reach $250k in 2025.

Buy Bitcoin GuideBitcoin Wallet TutorialCheck 24-hour Bitcoin PriceMore Bitcoin NewsWhat is Bitcoin?