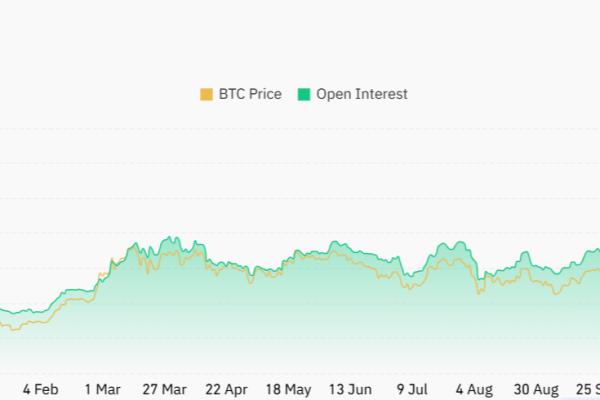

12% of Bitcoin Holders Face Unrealized Losses in Market Drop

Around 12% of Bitcoin addresses are now in unrealized losses, the highest level recorded since October 2024.Market liquidation surpassed $1.2 billion in the last 24 hours, triggering increased volatility and uncertainty among traders. Bitcoin price is under heavy pressure again after falling below $89,000, a level last seen in November. BTC is down 7.28% in...