The Indonesia stock market has moved higher in back-to-back sessions, collecting almost 130 points or 1.9 percent along the way. The Jakarta Composite Index now sits just beneath the 7,100-point plateau and it may add to its winnings on Wednesday.

The global forecast for the Asian markets suggests mild upside on easing treasury yields. The European markets were down and the U.S. bourses were up and the Asian markets figure to follow the latter lead.

The JCI finished modestly higher on Tuesday as gains from the financials and cement companies were capped by weakness from the resource stocks.

For the day, the index advanced 63.12 points or 0.90 percent to finish at 7,099.31 after trading between 7,065.03 and 7,149.19.

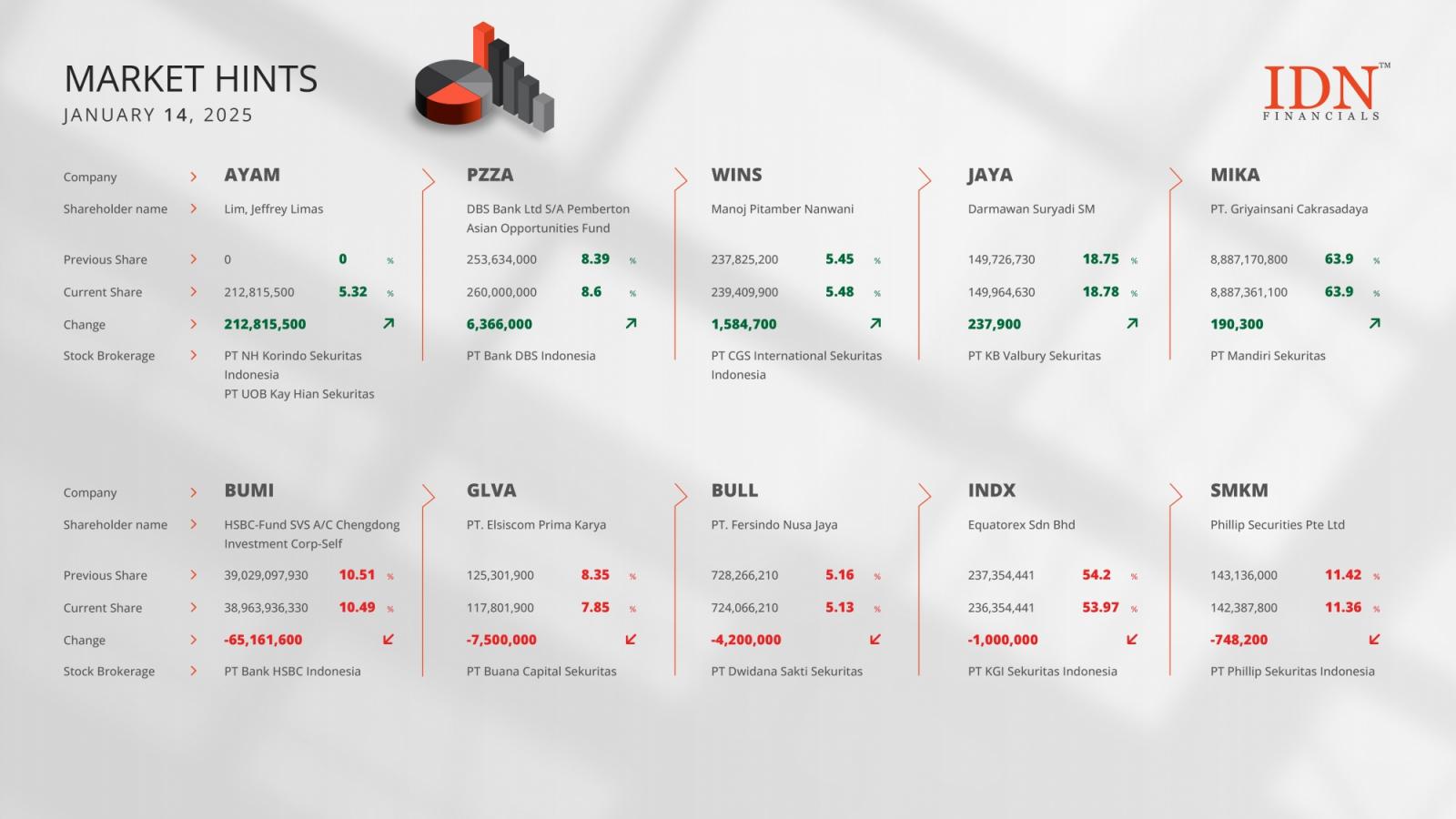

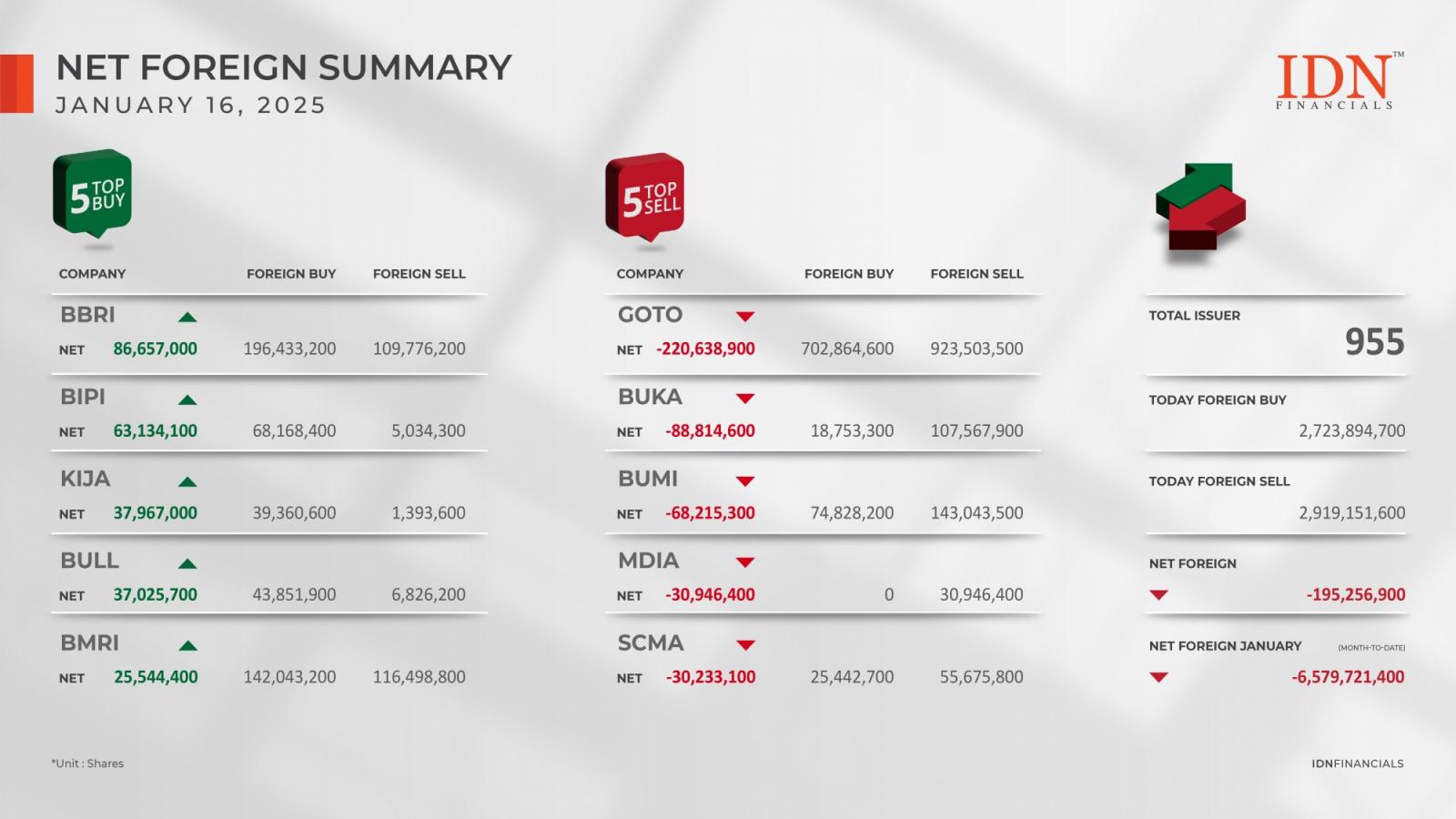

Among the actives, Bank Mandiri improved 0.82 percent, while Bank Danamon Indonesia rose 0.38 percent, Bank Negara Indonesia gained 0.43 percent, Bank Central Asia collected 0.81 percent, Bank Rakyat Indonesia retreated 1.77 percent, Indosat Ooredoo Hutchison strengthened 1.72 percent, Indocement skyrocketed 7.69 percent, Semen Indonesia surged 7.89 percent, Indofood Sukses Makmur increased 0.83 percent, Astra International jumped 1.78 percent, Energi Mega Persada rallied 2.82 percent, Astra Agro Lestari added 0.42 percent, Aneka Tambang tumbled 2.04 percent, Vale Indonesia plunged 3.89 percent, Timah slumped 1.74 percent, Bumi Resources plummeted 6.74 percent and United Tractors was unchanged.

The lead from Wall Street is cautiously optimistic as the major averages spent much Tuesday under water before a late rally nudged them modestly up into the green.

The Dow climbed 140.26 points or 0.36 percent to finish at 38,711.29, while the NASDAQ rose 28.38 points or 0.17 percent to close at 16,857.05 and the S&P 500 perked 7.94 points or 0.15 percent to end at 5,291.34.

The higher close by the major averages came on a notable decrease by treasury yields, which extended their recent decline. The yield on the benchmark ten-year note closed lower for the fourth straight session, pulling back further off the nearly one-month closing high last Wednesday.

The continued advance by treasuries came amid signs of weakness in the labor market, with a report from the Labor Department showing a modest decrease in U.S. job openings in April.

On Friday, the Labor Department is scheduled to release its more closely watched monthly jobs report, which could have a significant impact on the outlook for the economy and interest rates.

Oil prices fell on Tuesday, extending losses from the previous session amid concerns about possible oversupply in the market after OPEC decided to phase out voluntary production cuts from October. West Texas Intermediate crude oil futures for July fell $0.97 or 1.3 percent at $73.25 a barrel.