The Indonesia stock market on Monday ended the four-day winning streak in which it had advanced almost 80 points or 1.1 percent. The Jakarta Composite Index now sits just beneath the 7,280-point plateau although it\'s poised to rebound on Tuesday.

The global forecast for the Asian markets is upbeat on optimism over the outlook for interest rates. The European markets were down and the U.S. bourses were up and the Asian markets figure to follow the latter lead.

The JCI finished modestly lower on Monday following losses from the financial shares, resource stocks and cement companies.

For the day, the index sank 48.72 points or 0.66 percent to finish at 7,278.86 after trading between 7,252.81 and 7,346.10.

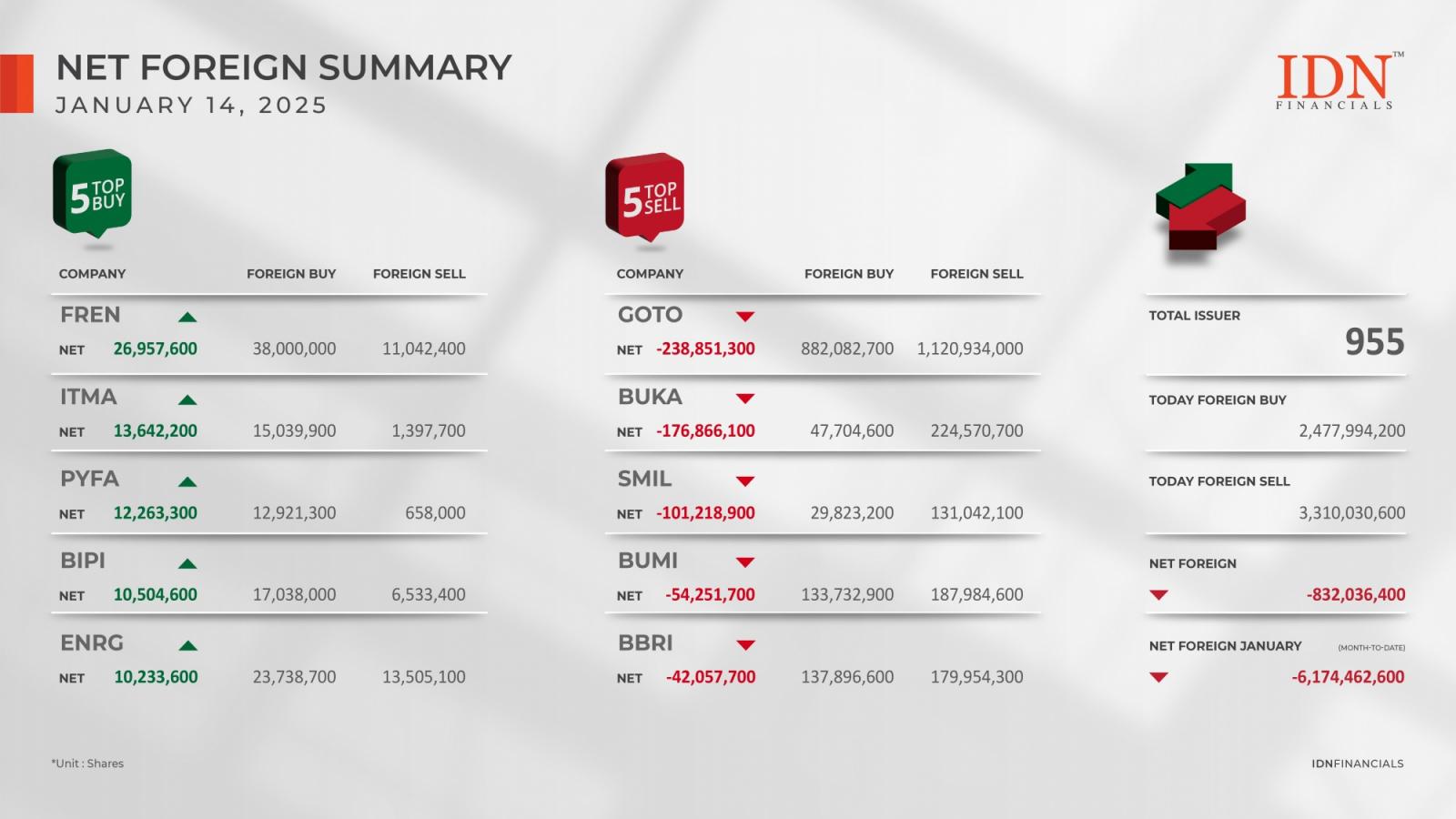

Among the actives, Bank CIMB Niaga shed 0.83 percent, while Bank Mandiri lost 1.17 percent, Bank Danamon Indonesia dropped 0.77 percent, Bank Central Asia dipped 0.25 percent, Bank Rakyat Indonesia stumbled 1.63 percent, Indosat Ooredoo Hutchison rose 0.22 percent, Indocement slumped 1.67 percent, Semen Indonesia shed 0.73 percent, Indofood Sukses Makmur added 0.42 percent, United Tractors climbed 1.06 percent, Astra International retreated 1.54 percent, Energi Mega Persada advanced 0.91 percent, Aneka Tambang sank 0.74 percent, Vale Indonesia declined 1.60 percent, Timah tumbled 2.01 percent and Bumi Resources, Astra Agro Lestari and Bank Negara Indonesia were unchanged.

The lead from Wall Street is positive as the major averages opened higher on Monday and stayed that way throughout the session to hit fresh record closing highs in somewhat choppy trade.

The Dow rallied 210.82 points or 0.53 percent to finish at 40,211.72, while the NASDAQ gained 74.12 points or 0.40 percent to close at 18,472.57 and the S&P 500 rose 15.87 points or 0.28 percent to end at 5,631.22.

The support on Wall Street was due largely to comments from Fed Chair Jerome Powell, who said that the central bank will not wait until inflation hits 2 percent to cut interest rates.

On the economic front, a report released by the Federal Reserve Bank of New York showed regional manufacturing activity contracted at a slightly faster rate in July.

Crude oil futures settled lower on Monday, weighed down by weighed down by political uncertainty following an assassination attempt on former President Donald Trump and weak economic data from China. West Texas Intermediate crude oil futures for August ended down $0.30 at $81.91 a barrel.